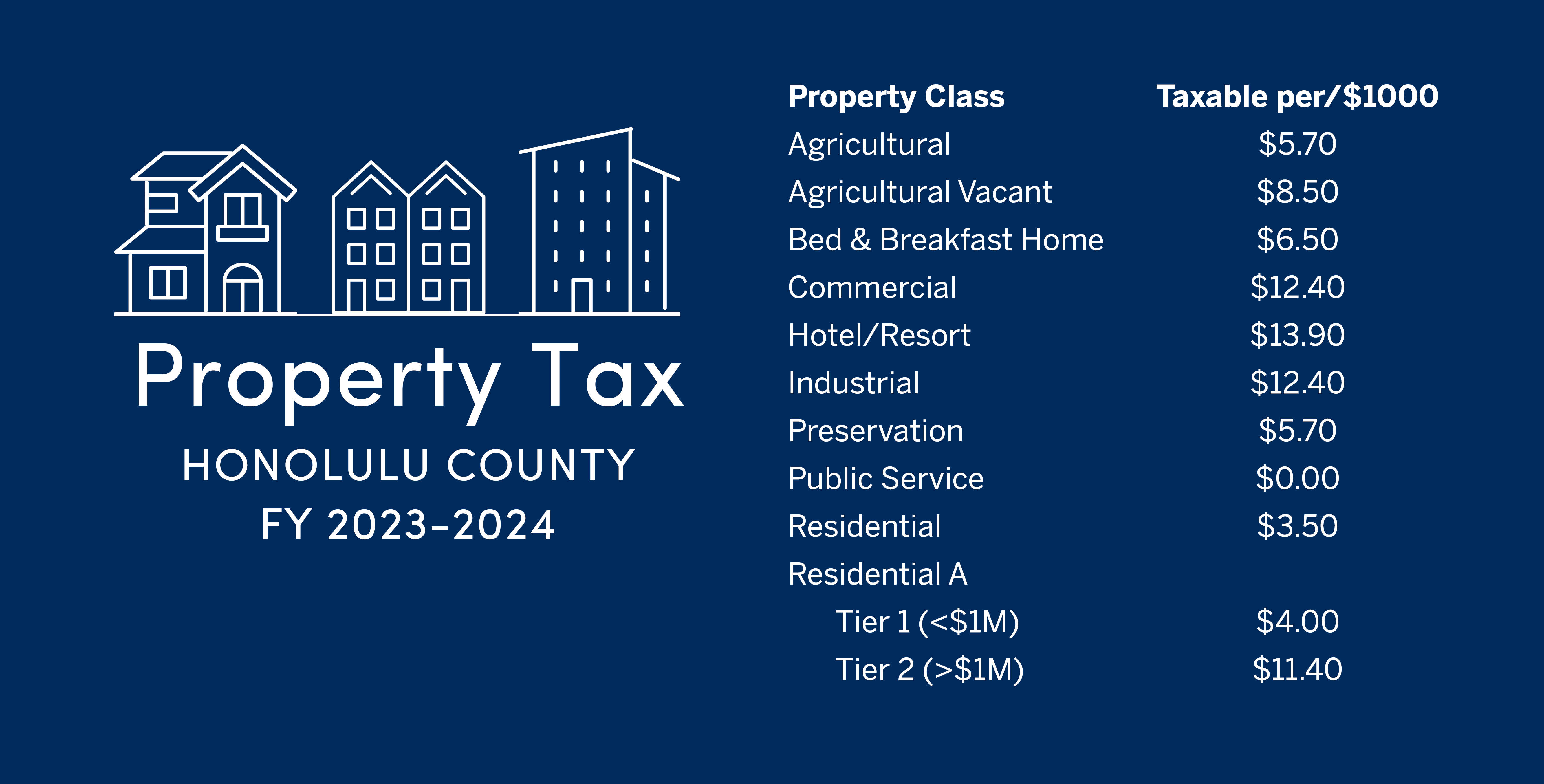

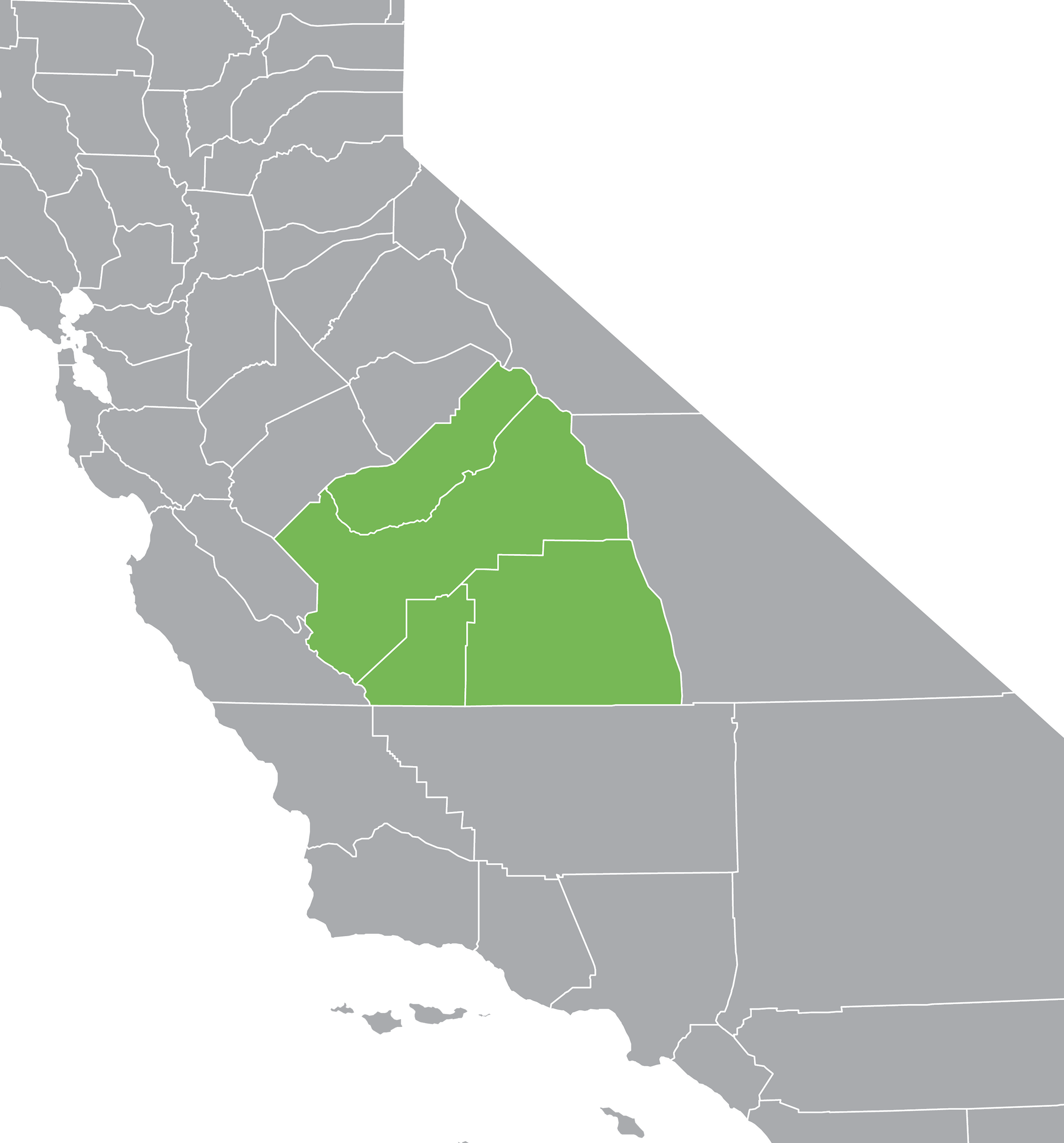

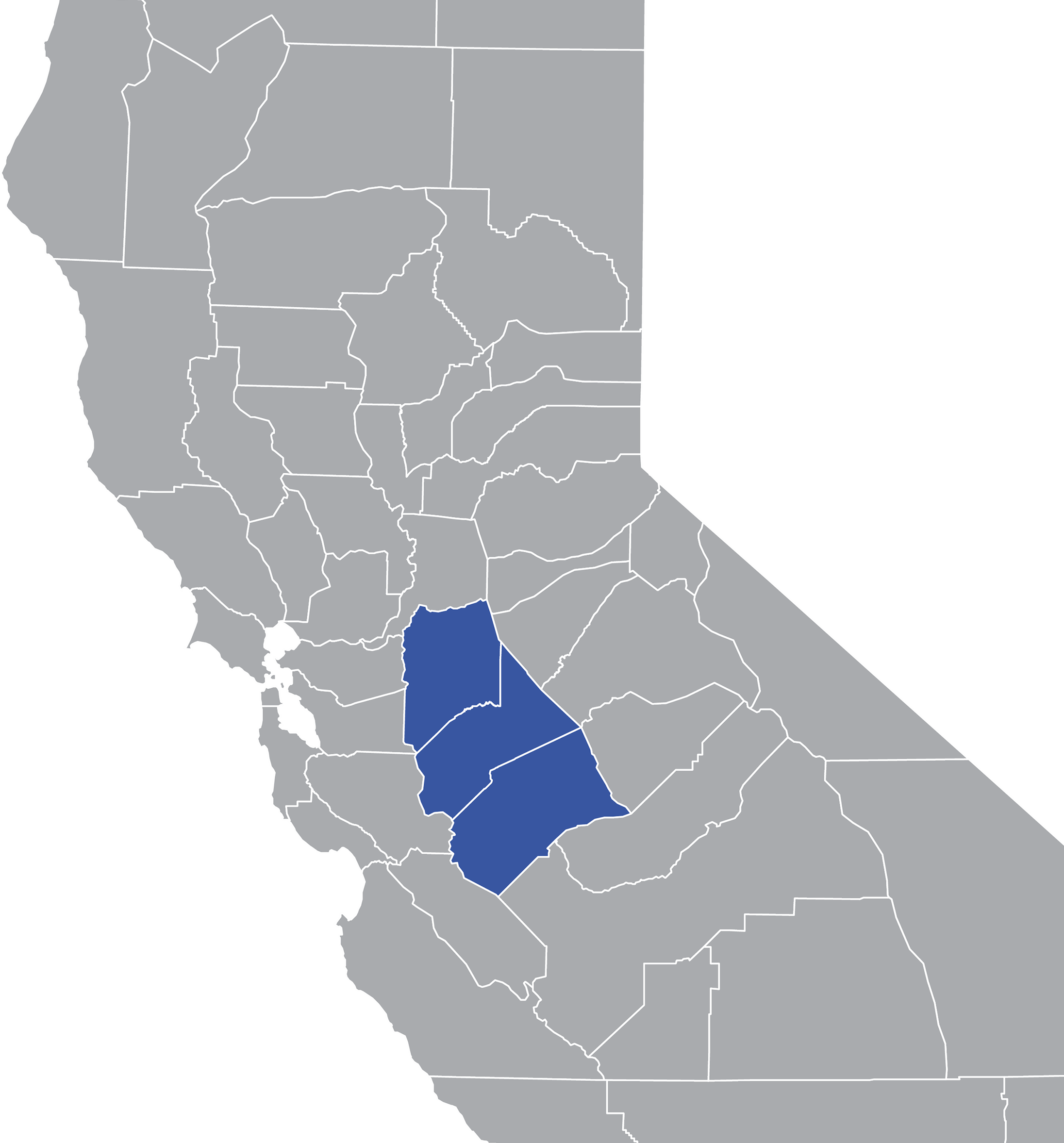

Webthe median property tax in san joaquin county, california is $2,340 per year for a home worth the median value of $318,600. San joaquin county collects, on average, 0. 73% of. Our mission is to ensure the safekeeping of public funds while. Webexplore the charts below for quick facts on san joaquin county effective tax rates, median real estate taxes paid, home values, income levels and homeownership rates, and. Weblearn all about san joaquin real estate tax. Whether you are already a resident or just considering moving to san joaquin to live or invest in real estate, estimate local. Webthe median property tax (also known as real estate tax) in san joaquin county is $2,340. 00 per year, based on a median home value of $318,600. 00 and a median effective. Weboverseeing the property tax billing and collection process for secured and unsecured property taxes levied by california state law, we assist the public in understanding their. Quickly find treasurer & tax collector phone number, directions & services (stockton, ca).

Related Posts

Recent Post

- Khan Academy Mcat Psych

- Eugina Cooney

- Rn Jobs Indeed

- Nascar Race Scanner Frequencies

- Smartstart Ignition Interlock

- Sarasota Herald Obituaries

- Florida Man January 11

- Autopsy Pictures Of Travis

- Meme About Husbands

- Bilas Sport

- San Diego Rain Forecast

- Rmcat

- Homeschooling Picker And Part Time Picker

- Yahoo Week 1 Fantasy Rankings

- Traffic News Nashville Tn

Trending Keywords

Recent Search

- Indeed Longview

- Indeed Staffing Agency

- Stepsister Wants Brther First

- California Highway 89 Road Closures

- Indeed Truck Driving Jobs

- Brazilian Butt Lift James Charles

- Part Time Ups Package Handler Salary

- Inmate Search St Tammany Parish

- Detective Homicide Salary

- Wbz Forecast

- Br Nfl Picks

- Indeed Jobs San Francisco Bay Area

- United States Air Force Wiki

- Ice And Fire Fanfic

- Zillow Rental Com

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)